Sensitivity Analysis in Excel: Step-by-Step Tutorial (With Template)

Sensitivity analysis is a powerful technique for understanding how changes in key variables impact your financial models. In Excel, it allows you to play "what-if" with your forecasts, moving beyond a single, static prediction to explore a range of potential outcomes. This guide will walk you through, step-by-step, how to perform sensitivity analysis in Excel, helping you identify risks, uncover opportunities, and make smarter, data-driven decisions.

Why Sensitivity Analysis Is a Critical Skill in Excel

Imagine you're launching a new product. You’ve built a detailed financial model in Excel with AI, and the projected profits look promising. But what happens if your marketing costs increase by 20%? Or if your customer conversion rate is just half a percent lower than anticipated? These aren't minor hypotheticals; they are real-world uncertainties that can significantly affect a project's success.

Spending too much time on Excel?

Elyx AI generates your formulas and automates your tasks in seconds.

Try for free →This is where running a sensitivity analysis in excel provides a decisive advantage. It moves you beyond a single, optimistic forecast, forcing you to prepare for various potential scenarios. Instead of hoping your assumptions are correct, you can systematically test them to determine which ones pose the greatest risk to your bottom line.

Identify Your Most Critical Variables

Every business plan is built on a set of core assumptions. The true value of sensitivity analysis is its ability to pinpoint these assumptions and precisely measure their impact. You can determine whether your profit is more vulnerable to a change in raw material prices or a dip in advertising performance. This knowledge tells you exactly where to focus your attention and resources.

By testing one variable at a time, you can get clear answers to critical business questions:

- Pricing Strategy: How much can we lower our price to remain competitive before the product becomes unprofitable?

- Cost Control: What is the maximum increase in supply costs we can absorb before our profit margin disappears?

- Marketing ROI: For each additional dollar invested in advertising, how much does our net profit increase?

This is more than a simple calculation; it's a strategic method for building resilience directly into your financial planning. You create models that tell the complete story, not just the best-case scenario.

Make Smarter, Data-Backed Decisions

Ultimately, the goal is to make better, more informed decisions. The insights gained from sensitivity analysis are essential when developing a robust feasibility study, as they demonstrate a project's viability under various conditions. It provides a solid, quantitative foundation for discussions with investors, executives, and other stakeholders, allowing you to support your strategy with hard data.

When you can present a range of possible outcomes, you demonstrate a deep, nuanced understanding of the business and its associated risks. This builds confidence and empowers your team to develop effective contingency plans. To better understand the functions that drive these models, our guide to the most important https://www.getelyxai.com/en/blog/excel-financial-formulas is an excellent resource.

How to Build a Dynamic Model for What-If Analysis

Before diving into a sensitivity analysis in Excel, you must first build a dynamic financial model. This means your spreadsheet needs to be interconnected, where changing a single "input" value automatically updates all related calculations and your final "output." This structure is the absolute foundation of effective what-if analysis.

Think of it as a domino effect. Your input variables are the first dominoes. When you change one, a series of linked formulas should instantly recalculate, triggering the next formula until the final result is updated. If your formulas contain hardcoded numbers instead of cell references, this chain is broken, and your analysis cannot proceed.

Setting Up a Practical E-commerce Profit Model

Let's walk through building a simple profit forecast model for an e-commerce store. We’ll focus on basic formulas because the structure is the most critical element for sensitivity analysis.

First, define your Input Assumptions. These are the variables you want to adjust to see their impact. It is a best practice to group these in a clearly labeled section at the top of your worksheet for easy access.

- Average Order Value (AOV): The average amount a customer spends per transaction.

- Website Conversion Rate: The percentage of website visitors who make a purchase.

- Monthly Ad Spend: The total marketing budget for the month.

- Cost Per Click (CPC): The average price paid for each click in a pay-per-click (PPC) campaign.

- Variable Cost per Order (% of AOV): The cost of goods sold and other direct expenses, expressed as a percentage of the AOV.

Next is the Calculation Engine. This section contains the formulas that use the inputs to produce meaningful results. The golden rule here is that every formula must reference an input cell, never a hardcoded number.

Finally, we have our Key Output. This is the primary result you are analyzing. For this model, our key output will be Net Profit.

The core principle is simple: maintain a clear separation between the cells you manually change (inputs) and the cells that calculate automatically (outputs). This discipline ensures your model is clean, reliable, and easy to understand.

Linking Everything Together with Formulas

Now, let's connect the inputs to the outputs using formulas. For our e-commerce example, the calculation flow is as follows:

- Total Website Visitors: Calculated from the advertising budget. The formula is

=MonthlyAdSpend / CPC. - Total Orders: Depends on how effectively the website converts traffic into sales. The formula is

=TotalWebsiteVisitors * WebsiteConversionRate. - Total Revenue: A straightforward multiplication:

=TotalOrders * AOV. - Total Variable Costs: Calculated based on revenue:

=TotalRevenue * VariableCostPerOrder. - Net Profit: The bottom line, calculated as revenue minus all costs:

=TotalRevenue - TotalVariableCosts - MonthlyAdSpend.

With this structure, changing the Conversion Rate in your input section will instantly update Total Orders, Revenue, Costs, and ultimately, Net Profit. This dynamic engine is precisely what Excel’s Data Tables and Scenario Manager are designed to work with. Following sound financial modeling best practices is crucial for keeping these models accurate and transparent.

If you're new to this, using a pre-built model can be a great way to learn. A good financial projections template for Excel can show you how professionals structure their financial models. Mastering this foundation will unlock the true power of what-if analysis.

Getting Started: One-Variable Analysis with Data Tables

With a dynamic e-commerce model in place, it's time to conduct a sensitivity analysis in excel. The most straightforward method is using a one-variable Data Table. This tool is designed to answer a fundamental question: "If I change this one variable, how does it affect my final result?"

Think of a Data Table as an automated stress test. It allows you to visualize the cause-and-effect relationship between a single business driver and a key performance indicator (KPI).

For our e-commerce example, we will explore how Net Profit responds to changes in the website conversion rate. We will test a range of possibilities, from a low of 1.0% to a high of 5.0%. The Data Table will perform all these calculations for us instantly.

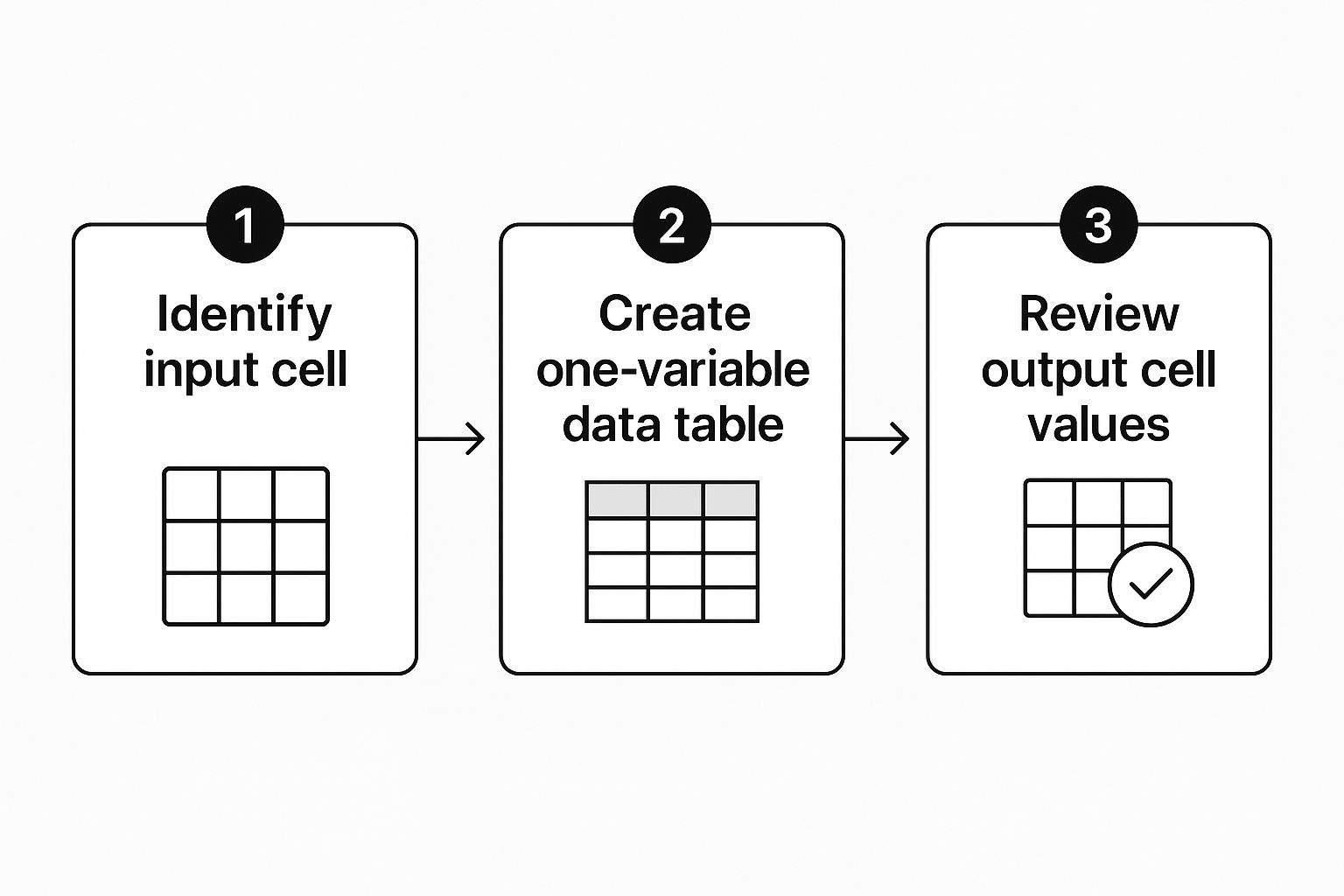

Building Your First Data Table

The setup process is simple, but the structure must be precise. First, find an empty area on your spreadsheet. In a single column, list the different values you want to test for your chosen variable. In our case, this will be our list of conversion rates: 1.0%, 1.5%, 2.0%, etc. This column is your input column.

Next, in the cell directly above and one column to the right of your input list, you must reference your final output cell. For example, if your Net Profit is calculated in cell B15, you would enter the formula =B15 in this cell. This tells Excel which result you want to track. Your table is now ready for analysis.

As you can see, the process flows from identifying your key cells to letting the Data Table feature populate the final results for you.

Running the What-If Analysis

With the structure in place, the rest is just a few clicks. Start by selecting the entire table range, including both your column of input values and the cell referencing your output.

Once the range is highlighted, navigate to the Data tab in the Excel ribbon. Click on What-If Analysis and select Data Table.

A small dialog box will appear with two fields: "Row input cell" and "Column input cell." Since our conversion rates are arranged in a column, we will use the "Column input cell" field. In this field, you need to select the original input cell in your financial model—the single cell where your website conversion rate is defined.

By linking the Data Table to this original cell, you are instructing Excel: "For each value in this column, temporarily substitute it into the model's main conversion rate cell, recalculate the entire model, and display the resulting Net Profit in this table."

Click OK, and Excel will instantly populate the column next to your inputs with the calculated Net Profit for each corresponding conversion rate.

Turning Data into Decisions

Creating the table is the first step; interpreting the results is where the value lies. You now have a clear, at-a-glance view of how sensitive your business is to changes in that one variable.

You can instantly identify the break-even point—the exact conversion rate at which your profit transitions from negative to positive. You can also quantify risk and answer critical questions like, "If our conversion rate drops by 0.5%, how much profit will we lose?" This transforms a vague concern into a concrete number that you can plan for.

This type of analysis is a cornerstone of modern financial modeling. With Microsoft reporting over 1.2 billion Excel users worldwide, it's an essential skill in finance and business.

While there are multiple ways to perform this analysis, the Data Table is often the most direct and visual method. You can learn about sensitivity analysis methods from the experts at Becker to explore other approaches.

This simple table transforms abstract risks into tangible figures, providing a powerful way to strategize and communicate what truly drives your business.

Excel Tools for What-If Analysis

Before we proceed to two-variable analysis, it's useful to understand the primary tools Excel offers for this type of work. Each tool has specific strengths depending on your objective.

| Tool | Best Use Case | Number of Variables | Key Feature |

|---|---|---|---|

| Data Tables | Quickly seeing how one or two inputs impact a single output. | 1 or 2 | Displays a full range of outcomes in a simple table format. |

| Scenario Manager | Comparing a few distinct, complex scenarios with multiple input changes. | Up to 32 | Saves and names different groups of inputs for easy comparison. |

| Goal Seek | Finding the exact input needed to achieve a specific target output. | 1 | Works backward from a desired result to find the required input. |

This table can help you select the appropriate tool for your analysis. For our purposes, Data Tables are ideal for exploring a continuous range of possibilities for one or two variables.

Running Advanced Two-Variable Scenarios

While analyzing one variable is a great start, business realities are rarely that simple. Often, multiple factors change simultaneously, and their combined effect is what truly matters. This is where a two-variable Data Table becomes an invaluable tool for a comprehensive sensitivity analysis in excel. It allows you to build a matrix of possibilities, showing how your bottom line shifts when two different inputs change at the same time.

Continuing with our e-commerce model, we can now explore what happens when both the Website Conversion Rate and the Average Order Value (AOV) fluctuate. This dual analysis provides a much richer, more realistic picture of potential outcomes. You move beyond a simple linear view to see how two critical drivers interact, helping you identify zones of high profitability and areas of significant risk.

Structuring a Two-Dimensional Data Table

Setting up a two-variable table is slightly different from the single-variable version. You are essentially creating a grid: one set of inputs runs down a column, the other runs across a row, and the cells where they intersect will display the result for that specific combination.

Here’s how to set it up:

- List Your First Variable: In a clear area of your worksheet, create a column listing the different conversion rates you want to test (e.g., 1.0%, 1.5%, 2.0%). This will be your Column Input.

- List Your Second Variable: In the row directly above the first value in your column, list the different Average Order Values you want to test (e.g., $40, $45, $50). This will be your Row Input.

- Link the Output Cell: This step is crucial. In the corner cell, where your input row and column meet, you must reference your final output cell. For our model, this means entering a formula that points to the Net Profit cell (e.g.,

=B15).

This corner cell acts as the blueprint, telling Excel which final number to calculate for every combination of your two variables.

Generating the Full Matrix of Scenarios

Once the structure is in place, filling the table is incredibly fast. Select the entire range—your input row, your input column, and all the empty cells where the results will be populated.

Navigate to the Data tab, click What-If Analysis, and select Data Table. This time, the dialog box will prompt you for two inputs:

- Row input cell: Link this to the original AOV cell in your main financial model.

- Column input cell: Link this to the original Website Conversion Rate cell in your model.

Click OK, and watch Excel perform the calculations. It will iterate through every AOV in your row, pair it with every conversion rate in your column, plug both values into your model, and place the resulting net profit in the corresponding cell. The output is a comprehensive grid showing dozens of potential outcomes instantly.

A two-variable Data Table is more than just a grid of numbers; it's a strategic map of your business's financial landscape. It helps you visualize how two key drivers interact, providing a perspective that a one-variable analysis cannot.

Reading the Matrix to Find Crucial Insights

With the table populated, the real analysis begins. You can scan the grid to uncover game-changing insights. For instance, you can quickly identify the break-even line—the combinations of conversion rate and AOV that result in a profit of $0.

You can also pinpoint the most profitable scenarios to help prioritize your team's efforts. Is it more impactful to launch a marketing campaign to increase AOV, or should you focus on improving website UX to lift the conversion rate? The data in this table helps you answer such questions with confidence.

This type of multi-dimensional analysis is standard practice for finance professionals. You can learn more about these powerful financial modeling techniques from Wall Street Prep. By applying these methods, you gain a much deeper understanding of what drives your business, turning a simple forecast into a truly powerful decision-making tool.

Using Scenario Manager for Big-Picture Decisions

Data Tables are excellent for analyzing how one or two variables affect your bottom line across a continuous range. But what if you need to compare entirely different future outlooks? This is where Scenario Manager, another powerful tool for sensitivity analysis in Excel, comes in.

Instead of examining a smooth range of inputs, Scenario Manager allows you to bundle a complete set of assumptions into distinct, named "scenarios." It is the perfect tool for presenting a few high-level strategic options to decision-makers without getting lost in the detail of a Data Table. Think of it as comparing different stories, each with its own set of circumstances.

When to Choose Scenario Manager Over Data Tables

The choice between these tools depends on the question you are trying to answer.

- Use Data Tables if you are asking: "How does our profit change as the conversion rate increases from 1% to 5%?" Here, you are exploring the impact of one or two variables across a continuous spectrum.

- Use Scenario Manager if you are asking: "How does our 'Optimistic Growth' plan compare to our 'Pessimistic Downturn' and 'Baseline' forecasts?" Here, you are comparing a few distinct situations, each involving multiple changing variables.

In short, Scenario Manager is designed for big-picture, "what-if" comparisons, making it an exceptional communication tool.

Creating and Saving Different Business Scenarios

Let's use our e-commerce model to build three distinct scenarios.

- Baseline Case: Our starting point, reflecting the most probable forecast based on current data.

- Pessimistic Case: This scenario models a market downturn. We will decrease the Website Conversion Rate, lower the Average Order Value (AOV), and increase the Cost Per Click (CPC).

- Optimistic Case: This scenario models a market boom. We will assume a higher Conversion Rate, a larger AOV, and a slightly increased Ad Spend to capture more market share.

To set these up, go to the Data tab, click What-If Analysis, and select Scenario Manager. From there, you will "Add" a new scenario, give it a clear name like "Pessimistic Case," and select all the input cells that will change in this version. After defining the changing cells, you simply enter the new values for that specific scenario. Repeat this process for each case you want to compare.

Think of Scenario Manager as a "save state" for your assumptions. It allows you to switch between different sets of inputs with just a few clicks, instantly recalculating your entire model to reflect a new reality.

Generating a Clear Summary Report

The true power of Scenario Manager lies in its ability to generate a clean, concise summary report. Once all your scenarios are defined, click the "Summary" button in the dialog box. Excel will then ask which output cells you want to see—for our model, this is the Net Profit cell.

Click OK, and Excel will generate a new worksheet with a perfectly organized table. This report presents all your scenarios in columns, showing the specific inputs for each one and, most importantly, the resulting Net Profit. It is an incredibly effective visual for presentations, as it clearly communicates the bottom-line impact of each strategic direction.

Excel's What-If tools are fundamental for making smart business decisions under uncertainty. You can find more insights on how these Excel tools help quantify uncertainty on BSuite365.com.

As you become more proficient, you may find the setup process repetitive. To work faster, consider learning how to automate Excel tasks and reduce manual effort.

Common Questions About Sensitivity Analysis in Excel

Even with a step-by-step guide, performing a sensitivity analysis for the first time can present challenges. This section addresses the most common questions and roadblocks users encounter.

Why Isn't My Data Table Updating?

This is the most frequent issue users face. You set up your Data Table perfectly, change an input in your model, and nothing happens in the table. This is not a bug; it's an intentional Excel feature designed to prevent performance issues in large workbooks.

By default, Excel's calculation mode is set to "Automatic Except for Data Tables." This prevents large tables from constantly recalculating with every minor change. To fix this, simply press the F9 key on your keyboard to force a manual recalculation of the entire workbook.

If you prefer automatic updates, you can change this setting by going to File > Options > Formulas. Under "Calculation options," switch the setting to "Automatic." Be aware that this may cause performance lag in very complex models.

Data Tables vs. Scenario Manager: What's the Difference?

These two tools are designed for different types of "what-if" analysis.

- Data Tables are best when you want to see how one or two variables impact an outcome across a continuous range. For example, testing how profit changes as you adjust the price from $10 to $20.

- Scenario Manager is used for comparing a handful of distinct, comprehensive situations. These scenarios often involve changing several inputs at once, such as comparing "Best Case," "Worst Case," and "Most Likely" forecasts.

A Data Table provides a granular map of a specific relationship. Scenario Manager offers a high-level, side-by-side comparison of a few possible futures.

How Do I Visualize My Sensitivity Analysis Results?

A table of numbers is useful for analysis, but a chart can tell a more compelling story.

For a one-variable Data Table, a Line Chart or Column Chart is ideal. These charts clearly show the relationship between your input (x-axis) and the result (y-axis), making it easy to spot trends and break-even points.

For a two-variable Data Table, avoid 3D charts, which can be misleading. A better approach is to use Conditional Formatting directly on the Data Table itself. Applying a simple red-to-green color scale transforms your grid of numbers into an intuitive heatmap, instantly highlighting the best and worst outcomes.

Can I Use AI in Excel for Sensitivity Analysis?

Yes, and the capabilities are growing rapidly. While AI cannot yet build a complete sensitivity analysis with a single click, it can significantly accelerate the process and assist with model creation.

AI assistants like Copilot for Microsoft 365 or other Excel add-ins can help you build the initial financial model. For instance, you could prompt it with, "Create a profit forecast model with inputs for unit price, units sold, and variable cost per unit," and it will generate the basic structure and formulas for you.

AI can also act as a brainstorming partner, helping you identify which variables are most critical to test or suggesting complex formulas. As these tools evolve, they will make powerful analytical techniques like sensitivity analysis more accessible to all users.

Ready to bring the power of AI directly into your spreadsheets? Elyx.AI is an intelligent Excel add-in that helps you analyze data, generate complex formulas, and get instant insights using simple, natural language. Stop wrestling with formulas and start having a conversation with your data.

Discover how Elyx.AI can transform your Excel workflow today.

Reading Excel tutorials to save time?

What if an AI did the work for you?

Describe what you need, Elyx executes it in Excel.

Try 7 days free