7 Key Accounts Payable Automation Benefits for 2025

Transforming the accounts payable (AP) department from a manual, paper-intensive cost center into a streamlined, strategic asset is no longer a distant goal. It's a tangible reality made possible through automation. For finance teams, project managers, and business owners, the daily grind of processing invoices, chasing approvals, and manually entering data creates significant operational friction. This manual approach is not just inefficient; it's a bottleneck that restricts growth, introduces unnecessary risk, and consumes valuable resources that could be better allocated to strategic financial planning and analysis.

This article moves beyond surface-level discussions to provide a detailed breakdown of the most impactful accounts payable automation benefits. We will explore seven critical advantages, from achieving significant cost savings and enhancing data accuracy to improving vendor relationships and strengthening compliance. Each point is designed to offer actionable insights and practical examples, demonstrating how implementing an automated system can fundamentally reshape your financial operations. The shift to AP automation is a prime example of realizing the broader benefits of digital transformation, creating a ripple effect of efficiency across the entire organization. Prepare to see how you can unlock newfound visibility and turn your AP function into a powerful driver of business intelligence.

1. Unlocking Superior Cash Flow Management

One of the most immediate and impactful accounts payable automation benefits is gaining precise control over your cash flow. Manual AP processes often create an information lag, where outstanding liabilities are not fully visible until invoices are physically processed. This delay makes it nearly impossible to forecast cash needs accurately or make strategic payment decisions.

Spending too much time on Excel?

Elyx AI generates your formulas and automates your tasks in seconds.

Try for free →AP automation centralizes all incoming invoices into a single, real-time dashboard. This gives you an up-to-the-minute view of your financial obligations, payment due dates, and available early payment discounts. With this clarity, you can move from a reactive payment cycle to a proactive cash management strategy, deciding exactly when to pay each supplier to optimize working capital.

From Theory to Practice: Real-World Examples

Many organizations have transformed their financial health through this approach. For instance, Walmart leverages AP automation to manage its massive network of over 100,000 suppliers, optimizing payment timing across global operations to preserve cash. Similarly, Unilever used automated payment scheduling to shorten its cash conversion cycle by an impressive 15 days. Even smaller businesses see significant gains; a manufacturing firm, XYZ Corp, reported a 40% reduction in cash flow variability after implementing an automated AP system.

How to Implement Strategic Cash Flow Control

You can harness these accounts payable automation benefits by focusing on a few key actions. Platforms like SAP Ariba and Oracle NetSuite are specifically designed to facilitate these strategies.

- Configure smart workflows: Set up payment approval rules that align with your weekly or monthly cash flow forecasts, ensuring you don't release funds before necessary.

- Automate discount capture: Configure the system to automatically flag and prioritize invoices with early payment discounts. This allows you to weigh the benefit of the discount against the value of holding onto cash longer.

- Integrate with financial systems: Connect your AP platform with treasury management or ERP systems for a holistic view of your company’s cash position, enabling more informed payment decisions.

- Regularly review payment strategies: Use the data from your automation platform to analyze payment patterns and adjust your timing strategies quarterly to maximize working capital.

2. Enhanced Accuracy and Error Reduction

Manual accounts payable processes are notoriously prone to human error, which can lead to costly consequences like duplicate payments, incorrect invoice amounts, and compliance issues. One of the most critical accounts payable automation benefits is the ability to virtually eliminate these mistakes. By leveraging technologies like Optical Character Recognition (OCR) and AI, automation systems capture and digitize invoice data with near-perfect precision.

This technology doesn't just extract data; it intelligently validates it against purchase orders and receiving reports through an automated three-way matching process. This systematic verification flags discrepancies instantly, stopping errors before they enter your financial records. The result is a dramatic increase in data integrity, reduced reconciliation efforts, and more reliable financial reporting.

From Theory to Practice: Real-World Examples

The impact of this enhanced accuracy is well-documented across industries. For example, Toyota successfully reduced invoice processing errors by an astounding 95% after implementing automated matching technology. In the public sector, the City of Phoenix used its AP automation system to eliminate an estimated $2.3 million in duplicate payments annually. A mid-size retailer, Fashion Forward, also saw its processing error rate plummet from 8% down to just 0.2%, saving thousands in overpayments and recovery costs.

How to Implement and Maximize Accuracy

To achieve these results, you need a strategic approach to implementation, often facilitated by platforms like MineralTree, AvidXchange, and Basware.

- Establish strict vendor data governance: Ensure your vendor master file is clean and up-to-date. Automation is only as good as the data it works with.

- Set up comprehensive validation rules: From day one, configure your system with strict rules for matching tolerances, duplicate invoice checks, and required data fields. You can discover how to automate data entry in Excel to understand foundational data handling principles.

- Provide regular training on exception handling: Equip your team to manage the small percentage of invoices that the system flags. A clear, efficient process for handling exceptions is key to maintaining momentum.

- Monitor error rates continuously: Use the platform’s analytics to track error trends and identify root causes. This data allows you to continuously refine your automation rules for even greater accuracy.

3. Faster Invoice Processing Speed

Another of the key accounts payable automation benefits is the dramatic acceleration of the entire invoice lifecycle. Manual systems are notoriously slow, with invoices often sitting on desks or lost in email inboxes for weeks. This creates bottlenecks, leads to late payment fees, and strains supplier relationships.

AP automation eradicates these delays by digitizing and streamlining every step, from receipt and data entry to approval and final payment. The system automatically ingests invoices, extracts key data, matches it against purchase orders, and routes it for approval instantly. This reduces processing times from weeks to just a few days or even hours, allowing teams to handle much higher volumes without adding headcount.

From Theory to Practice: Real-World Examples

Global leaders and even government bodies have demonstrated the power of this speed. For instance, Microsoft used automation to slash its average invoice processing time from 21 days down to just 3 days. Similarly, Heineken processes an astounding 1.2 million invoices annually, achieving an 80% straight-through processing rate with minimal human touch. A local government agency provides another powerful case study, cutting its lengthy 45-day processing cycle to a swift 8 days, improving public fund management.

How to Implement Accelerated Invoice Processing

You can achieve these efficiency gains by using dedicated platforms like Concur Invoice, Chrome River, and Coupa, which are built to optimize speed and accuracy. To truly accelerate invoice processing and minimize manual bottlenecks, strategies for mastering document workflow automation are essential.

- Design efficient workflows: Map your approval process and remove redundant steps. Configure the system to allow for parallel approvals, where multiple stakeholders can review an invoice simultaneously rather than sequentially.

- Set up automated reminders: Configure the platform to send automatic notifications to approvers for pending invoices, preventing them from becoming a bottleneck in the process.

- Implement mobile approval capabilities: Enable managers to review and approve invoices directly from their mobile devices, ensuring the process continues moving even when they are away from their desks.

- Monitor key processing metrics: Use the platform’s dashboard to track metrics like "average time to approve" and "invoices processed per day." Regularly analyze this data to identify and resolve any emerging slowdowns.

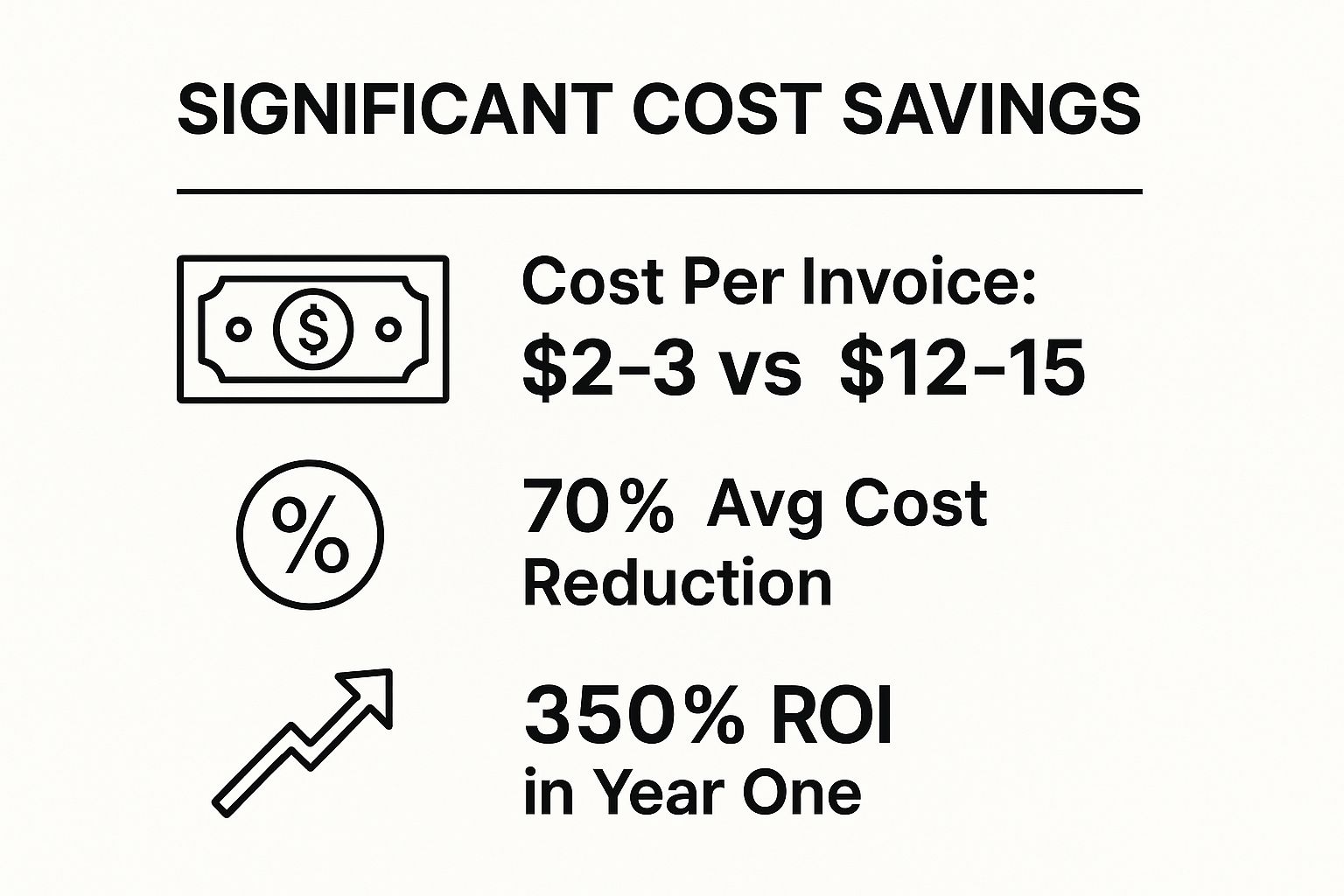

4. Significant Cost Savings

One of the most compelling accounts payable automation benefits is the direct and substantial reduction in operational costs. Manual AP is a resource-intensive process, burdened by labor costs for data entry, invoice matching, and approval chasing. It also incurs expenses for paper, printing, postage, and physical document storage, all of which are virtually eliminated with automation.

By digitizing and automating invoice processing, you can dramatically lower the cost per invoice. This shift moves your AP department from a costly administrative center to a streamlined, value-adding function. The savings extend beyond labor and materials, as automation also helps avoid late payment fees and strategically captures more early payment discounts, directly boosting your bottom line.

This infographic highlights the impressive financial impact organizations can expect from automating their AP processes.

These statistics demonstrate a clear and rapid return on investment, showcasing how automation turns a necessary expense into a source of significant savings.

From Theory to Practice: Real-World Examples

Global enterprises have realized massive savings through AP automation. For instance, General Electric saved an estimated $50 million annually after implementing a global AP automation solution. Similarly, Nestlé reduced its invoice processing costs by 70% while simultaneously managing a 40% increase in invoice volume. The impact is just as profound for smaller companies; a business like ABC Manufacturing successfully cut its cost per invoice from $15 down to just $3 after adopting automation.

How to Implement and Maximize Cost Savings

Achieving these accounts payable automation benefits is a strategic process. Platforms like Sage Intacct, Yardi, and BlackLine are designed to deliver these efficiencies.

- Calculate Total Cost of Ownership (TCO): Before implementation, analyze not just the software cost but also training and integration needs to build a clear business case and set a baseline for measuring success.

- Automate discount capture workflows: Configure your system to automatically identify and prioritize invoices with early payment discounts, ensuring you never miss an opportunity to save.

- Track and report savings: Use the platform's analytics to continuously monitor key metrics like cost per invoice and discount capture rate. These reports are crucial for demonstrating ROI to stakeholders. Read more about leveraging technology for financial reporting automation.

- Consider cloud-based solutions: Opting for a SaaS model can minimize upfront IT infrastructure costs and reduce ongoing maintenance expenses, accelerating your path to profitability.

5. Better Compliance and Audit Trail

One of the most critical accounts payable automation benefits is the ability to enforce stringent compliance and maintain an impeccable audit trail. Manual AP processes are prone to human error, inconsistent documentation, and procedural shortcuts, creating significant risks for regulatory non-compliance and making audits a time-consuming nightmare.

AP automation transforms compliance from a manual chore into an automated, systematic function. Every action, from invoice receipt to payment approval and execution, is digitally logged with a timestamp and user ID. This creates a complete, unalterable audit trail that is accessible on demand. Standardized workflows ensure that every invoice follows the exact same approval process, enforcing internal controls and meeting external regulations like the Sarbanes-Oxley (SOX) Act.

From Theory to Practice: Real-World Examples

Top organizations rely on automation to navigate complex regulatory landscapes. For example, JPMorgan Chase leverages AP automation to maintain strict SOX compliance across its vast global financial operations, ensuring every transaction is traceable. In the healthcare sector, a major hospital network reported a 75% reduction in audit preparation time after implementing automated documentation retrieval. Similarly, a multinational manufacturing company passed a rigorous regulatory audit with zero findings, crediting its automated AP controls for ensuring consistent policy enforcement.

How to Implement Stronger Governance

You can harness these compliance-focused accounts payable automation benefits by implementing specific system configurations. Platforms like Workday are often implemented with guidance from firms like PwC and Deloitte to ensure compliance frameworks are built directly into the workflows.

- Configure approval workflows: Design multi-level approval hierarchies that enforce the segregation of duties, preventing a single individual from controlling an entire transaction.

- Set automated retention policies: Program the system to automatically store and archive documents like invoices and POs for the period required by tax laws or industry regulations.

- Use exception handling rules: Create automated flags for duplicate invoices, mismatched PO numbers, or unapproved vendors to prevent fraudulent or non-compliant payments before they happen.

- Leverage reporting for audits: Train your internal and external auditors to use the system's reporting features to pull necessary documentation directly, drastically simplifying the audit process.

6. Enhanced Vendor Relationship Management

Beyond internal efficiencies, one of the most strategic accounts payable automation benefits is the ability to transform supplier relationships from transactional to collaborative. Manual AP processes often cause friction with vendors due to lost invoices, delayed payments, and a lack of transparency into payment status. This friction can lead to strained relationships, less favorable terms, and constant follow-up inquiries that drain both your team's and your vendors' time.

AP automation creates a reliable, transparent, and efficient payment ecosystem. It ensures that invoices are processed accurately and paid on time, building trust and positioning your company as a preferred customer. Features like self-service vendor portals empower suppliers to check invoice status and payment schedules 24/7, dramatically reducing the need for back-and-forth communication and fostering a stronger, more positive partnership.

From Theory to Practice: Real-World Examples

Strong vendor relationships directly translate to business advantages. For example, Procter & Gamble (P&G) improved its vendor satisfaction scores by 40% after implementing AP automation with self-service portals, strengthening its supply chain partnerships. Similarly, Coca-Cola used real-time status visibility to reduce vendor payment inquiries by a remarkable 85%. On a smaller scale, a regional distributor successfully negotiated an additional 2% in discounts from key suppliers simply by demonstrating consistent, reliable payment performance enabled by automation.

How to Implement Strategic Vendor Management

You can leverage these accounts payable automation benefits to build stronger partnerships using dedicated platforms like the Ariba Network or Taulia.

- Provide comprehensive vendor onboarding: Create a seamless onboarding process within the platform, including training materials and clear instructions on how to use the self-service portal.

- Set up automated notifications: Configure the system to send automatic confirmations when an invoice is received, approved, and paid. This proactive communication builds confidence and reduces inquiries.

- Implement electronic payment methods: Utilize ACH, virtual cards, or wire transfers for faster and more secure payment processing, ensuring vendors receive funds promptly.

- Use analytics to reward top partners: Leverage the data in your AP system to identify vendors with excellent performance and offer them preferential terms or early payment options, solidifying your strategic relationships.

7. Increased Visibility and Control

A significant, yet often overlooked, accounts payable automation benefit is the unprecedented visibility it provides into your entire financial workflow. Manual systems operate like black boxes, with invoices disappearing into a maze of paper trails, emails, and spreadsheets. This lack of transparency makes it impossible to track progress, identify bottlenecks, or analyze spending in real time.

AP automation transforms this opaque process into a transparent, data-rich ecosystem. It centralizes every invoice, purchase order, and payment into a single dashboard, offering real-time insights into the status of every transaction. This comprehensive view empowers management with the data needed to make strategic decisions, monitor vendor performance, and gain complete control over company spending.

From Theory to Practice: Real-World Examples

Top organizations leverage this enhanced visibility to drive significant operational improvements. For example, IBM utilizes AP automation analytics to optimize its global procurement strategy across 170 countries, ensuring consistency and efficiency. The University of California system implemented automation to gain clear visibility into its massive $3 billion annual spend, unlocking new cost-saving opportunities. Similarly, a mid-sized manufacturing company identified over $500,000 in potential savings by using spend analytics to renegotiate vendor contracts.

How to Implement Strategic Visibility and Control

You can achieve this level of oversight by using the powerful reporting and analytics features found in modern AP platforms. Tools like Tableau and Microsoft Power BI often integrate with these systems to turn raw data into actionable insights.

- Set up role-based dashboards: Customize dashboards to provide relevant KPIs and data visualizations for different users, from AP clerks tracking invoice statuses to CFOs monitoring overall spend.

- Establish KPIs for regular reviews: Define and track key performance indicators such as invoice processing time, exception rates, and on-time payment percentages to measure efficiency.

- Use analytics for process improvement: Dive into the data to identify recurring bottlenecks, such as specific vendors who consistently submit problematic invoices, and address the root causes. For a deeper understanding of how data can guide your strategy, learn more about leveraging business intelligence for your startup.

- Create automated exception reports: Configure the system to automatically generate and distribute reports on exceptions like duplicate invoices or price discrepancies, enabling proactive management.

7-Key Benefits Comparison

| Aspect | Improved Cash Flow Management 💡📊 | Enhanced Accuracy and Error Reduction ⭐📊 | Faster Invoice Processing Speed ⚡🔄 | Significant Cost Savings ⚡📊 | Better Compliance and Audit Trail ⭐💡 | Enhanced Vendor Relationship Management 💡📊 | Increased Visibility and Control 📊💡 |

|---|---|---|---|---|---|---|---|

| Implementation Complexity 🔄 | Medium – Setup, ERP integration | Medium – OCR and validation rules setup | Medium – Workflow design needed | Medium – Software investment | Medium – Compliance policy maintenance | Medium – Vendor onboarding effort | Medium – Custom reporting and training |

| Resource Requirements ⚡ | Moderate – Staff training, IT | Moderate – Training, tech for OCR | Moderate – Reliable connectivity | Moderate – Licensing & IT | Moderate – Regular updates & audits | Moderate – Support & training | Moderate – Consistent data input |

| Expected Outcomes 📊 | Optimized cash flow, better terms | Near-elimination of payment errors | 70-90% faster invoice processing | 60-80% processing cost cut | Simplified audits, reduced compliance risks | Improved vendor satisfaction, stronger relations | Real-time insights, bottleneck detection |

| Ideal Use Cases 💡 | Companies managing complex payables | Error-prone manual invoice processing | High-volume invoice environments | Cost-conscious organizations | Regulated industries needing audit trails | Businesses focused on supplier management | Decision-driven management teams |

| Key Advantages ⭐/⚡/📊/💡 | 💡📊 Strategic payments & forecasting | ⭐📊 Accuracy & error reduction | ⚡🔄 Speed & volume handling | ⚡📊 Cost reduction & ROI | ⭐💡 Compliance & internal controls | 💡📊 Vendor satisfaction & negotiation | 📊💡 Enhanced control & analytics |

Your Next Step: From Insight to Implementation

We've explored the transformative landscape of accounts payable automation, moving far beyond simple data entry to uncover a suite of strategic advantages. The journey from manual, paper-laden processes to a streamlined, digital workflow is not just an upgrade; it's a fundamental reimagining of your finance department's role within the organization. The core theme is clear: automation frees your team from the tactical trenches of processing invoices, allowing them to ascend to a more strategic, analytical, and value-driven position.

The accounts payable automation benefits we've detailed, from strengthening cash flow management to enhancing vendor relationships, are not isolated perks. They are interconnected components of a more resilient, intelligent, and competitive financial operation. Improved accuracy isn't just about avoiding mistakes; it's about building trust in your financial data. Faster processing isn't just about speed; it's about capitalizing on early payment discounts and improving your company's reputation.

Synthesizing the Benefits for Strategic Advantage

To truly harness the power of this technology, it's crucial to view these benefits through a holistic lens. Consider how they converge to create a powerful business case:

- Financial Health: Significant cost savings combined with optimized cash flow directly fortify your company's bottom line. You are not just spending less; you are making your capital work more effectively.

- Operational Excellence: The fusion of faster processing speeds, enhanced accuracy, and increased visibility creates a highly efficient operational engine. This reduces friction, eliminates bottlenecks, and provides the control needed to navigate complex financial landscapes.

- Risk Mitigation & Relationships: Robust compliance capabilities and comprehensive audit trails protect your business from regulatory penalties. Simultaneously, improved communication and reliable payments transform vendor relationships from transactional exchanges into strategic partnerships.

The transition to an automated AP system is a strategic initiative that pays dividends across the entire organization. It empowers finance teams, project managers, and even small business owners to make decisions based on real-time, accurate data rather than historical guesswork.

Charting Your Course to Automation

The path forward begins with a clear assessment of your current processes. Identify the most significant pain points: Are late payments straining vendor relations? Are manual errors causing costly rework? Is a lack of visibility hindering your forecasting ability? Answering these questions will illuminate where automation can deliver the most immediate and impactful results.

Embracing the full spectrum of accounts payable automation benefits is about more than just adopting new software. It is a commitment to fostering a culture of efficiency, data-driven decision-making, and continuous improvement. By taking this step, you position your organization not just to keep pace with the modern business world, but to lead the way with a smarter, more agile financial core.

Ready to transform your data analysis and automate your financial reporting directly within your spreadsheets? Discover how Elyx.AI can bring the power of AI to your fingertips, helping you unlock the insights discussed in this article with unparalleled ease and efficiency. Visit Elyx.AI to see how our intelligent tools can streamline your workflows today.

Reading Excel tutorials to save time?

What if an AI did the work for you?

Describe what you need, Elyx executes it in Excel.

Try 7 days free